Post Capitalism Architectures (2040)

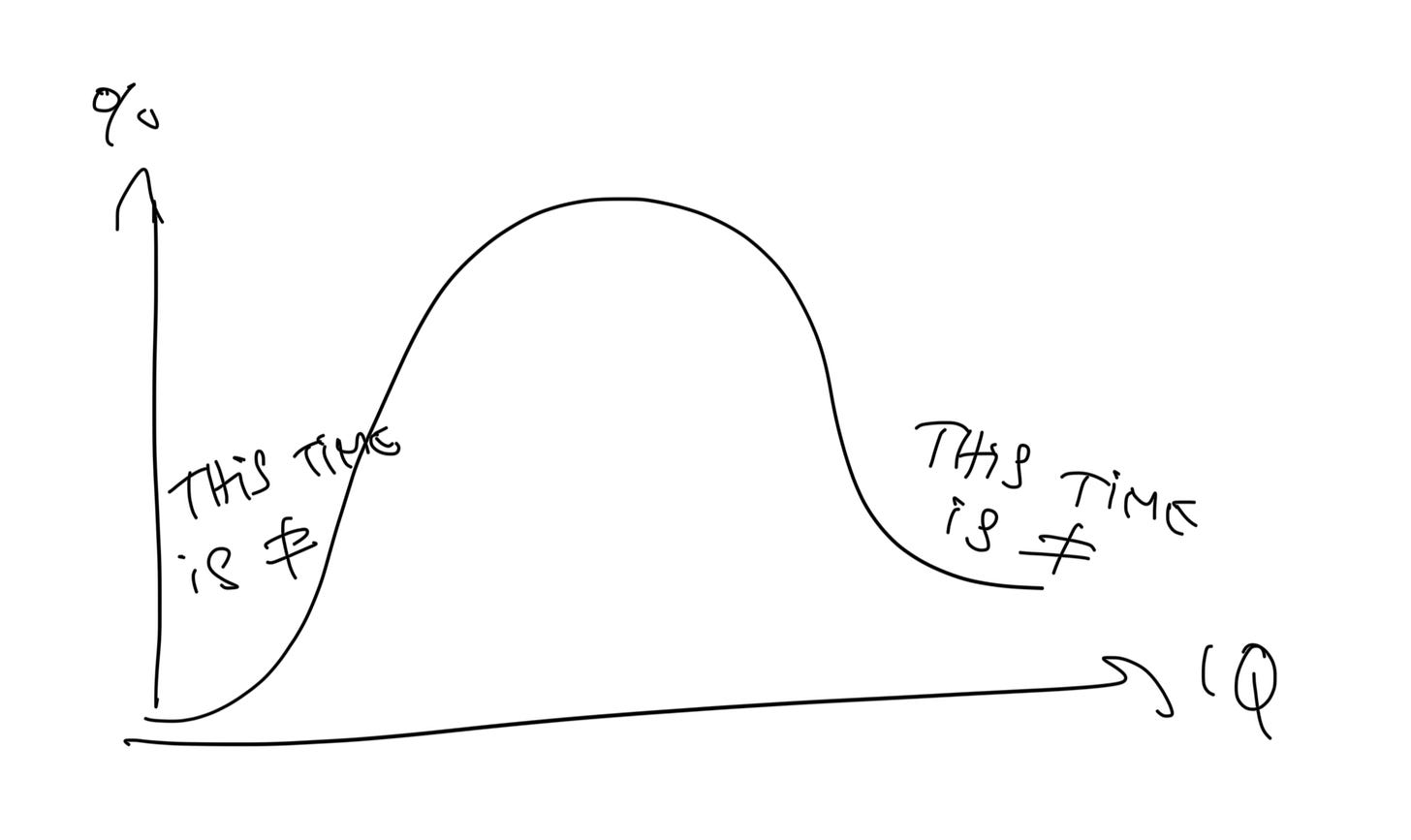

This time is different...

What is an economic system

An economic system is a coherent set of mechanisms, institutions, and rules that organize the production, distribution, and consumption of resources within a society.

It’s the structure through which a society answers three fundamental questions:

What to produce?

How to produce?

For whom to produce?

It articulates multiple dimensions:

Ownership logic (private, public, collective).

Coordination mechanisms (market, hierarchy, planning, networks).

Resource allocation modes (prices, quotas, needs, rights).

Examples:

Capitalism is based on private ownership of production means and market coordination.

Communism rests on collective ownership and centralized planning.

No economic system is ever “pure.” In practice, every system is hybrid.

France, for example, is not pure capitalism but a mixed economy: market + state + redistribution + social norms.

Why ask this question now ?

Because : Yes, people, this is is different

Tech-driven Deflation: AI and technological advancements significantly reduce production costs, causing structural deflation (see Booth, The Price of Tomorrow)

AI-driven Egalitarianism: Everyone accesses identical AI tools (GPT, Google, Netflix), reducing economic advantages from exclusive knowledge or information.

Post-Labor Economics (PLE): Traditional labor (trading human effort for wages)is becoming outdated due to AI-driven efficiency.

Mass Corporate Extinction: AI's capability to automate tasks threatens numerous industries, notably SaaS, tech services, finance, law, and education.

Decline of IQ Relevance: Intelligence (IQ) loses economic value, similar to physical strength post-industrial revolution.

Machine-driven Mass Unemployment: Automation via software and hardware (robots, autonomous vehicles) will displace vast numbers of workers, transforming labor markets profoundly.

Emergence of AGI/ASI: Advanced AI and superintelligence debates highlight imminent, transformative changes in society and economy.

Economic System Reinvention: Just as the Industrial Revolution ended feudalism, AI necessitates a fundamentally new economic structure adapted to post-labor realities.

Scenario 1 – Technofeudalism

What is Technofeudalism :

Yanis Varoufakis uses the term techno-feudalism to describe the emerging post-capitalist system.

It’s not late-stage capitalism, it’s something else. A shift in the mode of production, not just an evolution of the old one.

Simple definition: Techno-feudalism is a system where wealth no longer comes from exploiting labor in a competitive market, but from rent extraction by private digital platforms that control access to the economy.

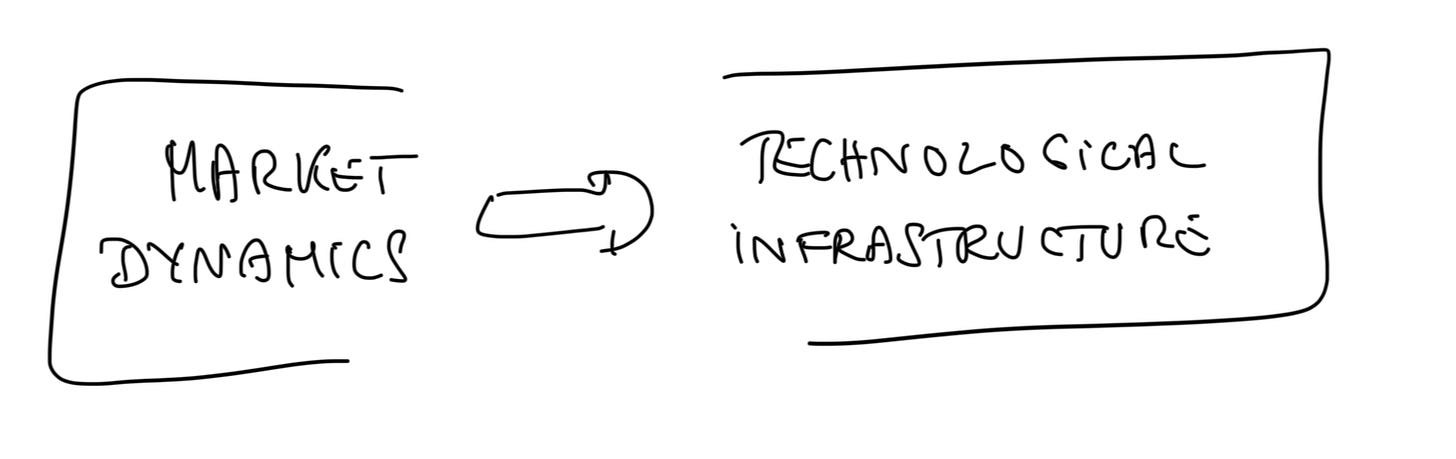

Technofeudalism differs fundamentally from capitalism by redefining control, power, and economic relationships through technological infrastructure rather than traditional market dynamics.

In capitalism, wealth primarily emerges from owning and managing capital, labor, and production. Market competition, property rights, and profit maximization dictate power dynamics.

Technofeudalism, however, replaces these market-driven dynamics with monopolistic control of digital infrastructure : platforms, data, algorithms, and network effects. Power shifts from capital ownership to gatekeeping of digital access and proprietary technologies.

Platforms such as Amazon, Google, and Meta become feudal-like entities, extracting rents and data from users dependent upon them.

Under technofeudalism, profit is not solely derived from productive innovation or competition but from monopolistic dominance, surveillance-based data extraction, and perpetual user dependency.

Economic relationships transition from capitalist voluntary exchanges toward digital serfdom, where participation is necessary but not empowering, creating permanent asymmetries in wealth, influence, and autonomy.

In short: capitalism relies on market forces, property rights, and competitive profit-seeking. Technofeudalism thrives on centralized technological dominance, digital rent-seeking, and structural dependency.

Productive forces: digitalization, data, algorithms

Production tools are no longer machines, but algorithms, servers, networks.

Data is the new raw material. Human labor becomes peripheral.

Platforms (Google, Amazon, Facebook, Apple, Microsoft, Alibaba, Tencent, Palantir...) are the lords of the new regime.

Relations of production: platforms & vassals

In capitalism, firms produce goods sold on markets.

In techno-feudalism, platforms produce almost nothing. They own the gates to the markets, they are proprietary intermediaries.

You’re not “employed,” you’re a vassal of a platform (Uber, YouTube, Shopify...).

You don’t sell in a free market, you rent the right to exist inside a closed digital space.

You’re subject to their algorithms, opaque rules, and taxes (20–50% commissions).

Varoufakis:

“Under techno-feudalism, the cloud capitalists are lords, and we are their serfs, paying rent to access the digital land.”

End of market, end of competition

Prices are no longer set freely by supply and demand. They’re manipulated by platforms. Example: Amazon decides which seller is visible. Facebook decides which content is seen.

There’s no market in the “Hayekian” sense. Just walled gardens with total surveillance.

Money and capital become secondary

In capitalism, the engine is capital seeking profit.

In techno-feudalism, capital is replaced by access control.

It’s not “I produce and profit,” it’s: “I control the flow and collect rent” (subscriptions, commissions, ads, data).

Money itself is bypassed. Apple can block your access to your audience. No need for a bank freeze. That’s more powerful than a state.

Role of the state: vassalized or complicit

The state is no longer sovereign. It’s either complicit (through favorable regulation) or vassalized (dependent on data, infrastructure).

Example: public administration uses Microsoft, schools depend on Google, intelligence agencies rely on Palantir.

Conclusion:

Techno-feudalism is:

End of competition.

End of the traditional capitalist class.

End of classic wage labor.

Extreme centralization.

Algorithmic rent as core engine.

A historical regression disguised as technological progress.

Scenario 2 – Gosplan AI

What was the Gosplan (1921-1991) and why it failed?

Gosplan was the Soviet Union's State Planning Committee responsible for centralized economic planning. Across the USSR the Gosplan :

determined production targets

allocated resources

coordinated economic activity

Gosplan translated ideological objectives into concrete numerical quotas, forming the backbone of Soviet command economics. Famously associated with Five-Year Plans, Gosplan aimed for rapid industrialization, collectivization, and economic self-sufficiency.

Critics argue Gosplan created systemic inefficiencies and chronic shortages due to unrealistic targets and lack of market signals (prices).

What is Gosplan AI?

The economic system of a Gosplan-AI would function like a brain, not a market.

It’s a system centered on perfect information, real-time forecasting, and full algorithmic coordination.

No prices.

No market.

No profit.

Only data flows and AI-driven allocations, like a central nervous system.

General structure: the economic “cortex”

A central AI (or a network of interconnected models) becomes the supreme coordination node.

It continuously receives data from every sector: production, consumption, transport, energy, health, education, environment…

This AI models the economy as a cybernetic system: inputs, outputs, feedback loops.

It learns, corrects, anticipates.

It acts like a homeostatic regulatory organ.

Planning mechanism: dynamic optimization

The “plan” isn’t fixed (as in the USSR). It’s permanent and adaptive.

It’s predictive control, like in robotics.

At every moment, the AI:

Evaluates stocks, needs, productive capacities

Anticipates shocks (climate, logistics, social)

Updates production decisions

Allocates resources (labor, energy, raw materials, human attention)

You get macro-planning (strategic objectives) and micro-distribution (who produces what, for whom, when, where).

Role of economic agents: functions, not owners

There are no “companies” in the capitalist sense.

Production units are functional entities within the plan, like organs in a body.

Humans are assigned to productive or creative roles based on:

Their marginal utility

Declared preferences (as much as possible)

Global constraints (ecological, energetic, social)

Wages? Optional.

Incomes could be calculated as access rights to consumption, based on contribution, needs, or equality principles. We can think about an adaptive universal basic income.

Money becomes a coordination tool, not a speculation tool.

Role of money (CBDC)

CBDCs are personalized allocation interfaces.

They let the AI track every agent’s economic behavior in real-time.

They’re programmable: money can be geolocated, time-limited, conditional (e.g., food subsidy usable only for certain products, in a zone, at a time).

Money isn’t for “profit.” It’s for coordinating flows.

Innovation, testing, feedback

Innovation no longer emerges from market competition.

It’s orchestrated by the system:

Identify high-potential sectors

Allocate experimental resources

Evaluate in real-world conditions (systemic A/B testing)

Integrate successful variants into the plan

It’s close to evolutionary planning, Darwinian computation by AI.

Incentives and motivation

Motivation becomes intrinsic and status-based: social recognition, algorithmic status, reputation.

A kind of economic social credit could emerge: Your “contribution score” determines access to goods, services, privileges.

Already embryonic in China.

Full loop example: food production

AI detects rice stock shortage in a region.

Models local demand, weather, agricultural capacity.

Reprograms logistics, allocates more land to rice.

Modulates rations to prevent shortages.

Redirects CBDC credits to rice substitutes.

Ensures nutritional balance.

All without prices, markets, or private firms. Just signals, flows, optimization loops.

In summary

You move from: A chaotic, self-organized, decentralized market to a central, adaptive, algorithmic, total planning brain.

The original Gosplan was run by humans. The Gosplan AI is run by algorithm.

Information becomes sovereign raw material.

Humans become decision nodes in a graph.

The economy becomes a goal-driven algorithm.

It’s post-monetary cyber-communism.

Or a perfect economic panopticon, depending on who runs the machine.

Scenario 3 – Individual Incorporation

What is the scenario of The Unincorporated Man?

The Unincorporated Man (Dani & Eytan Kollin, 2009) describes a dystopian ultracapitalist system pushed to its logical extreme:

Every individual is a publicly traded company.

Core principle: human incorporation

At birth, each person is incorporated.

You become a legal economic entity, listed and tradable.

You don’t own yourself 100%.

You start with 49% of your shares. The rest is held by: 20% for Parents (initial investment) 5% for the State (social investment), then private investors (education, housing, healthcare)

You must buy back your shares to gain autonomy, but usually can’t.

If you own stock of a person you can direct an audit.

You can’t opt out of incorporation (it’s social heresy).

That’s why the hero, Justin Cord, is scandalous: cryogenically revived, he’s the only unincorporated man. He owns 100% of himself.

The human market: life speculation and choice restrictions

People sell shares of themselves to fund education, mobility, and projects. In exchange, they sacrifice choice.

Shareholders can vote on major life decisions (career, marriage, location) if they hold enough equity. You’re literally under market pressure. You must perform. Be “profitable.” Maximize output. This is shareholder totalitarianism.

End of individual freedom. You’re no longer a person. You’re a living asset. Rated, modeled, tracked, managed.

No longer labor vs capital. You (labor) are capital. Everyone becomes both a startup and a financial product.

State’s role: infrastructure + market policing

The state is not socialist or authoritarian. It’s a neoliberal technocracy, obsessed with market fluidity.

It’s forbidden for the government to have any monopoly (including on the justice system). Government collects profits on the 5% of all incorporated humans (40Bn humans) and they have to spend it.

It protects property, contracts, and transparency. But not autonomy (redefined as tradable personal capital).

Economic and social consequences

Everything becomes transactional: friendship, love, family, work.

High performers attract top investors and get more autonomy / or get richer.

Low performers remain in lifelong soft exploitation via equity debt.

There are no social classes in the Marxist sense, just people who own their majority and people who don't.

Just a fluid hierarchy of individual financial valuations. It’s no longer man exploited by capital. It’s man as capital, taken to the absurd.

Money

Every entity = currency issuer (ft Hayek)

Major institutions (companies, universities, cities, influencers) issue their own currency backed by reputation, perceived value.

No central authority, no monetary policy

No central bank. No macro policy. No monopoly. No managed inflation or deflation. Each currency fluctuates with trust in its issuer.

Lose credibility, your currency crashes like a stock.

Salaries and transactions = constant arbitrage

You’re paid in a mix of currencies: 40% StanfordCoin, 30% AppleDollar, 20% TeslaCredits, 10% SelfCoin.

People constantly decide:

Which currency to hold?

Which to convert?

Which to trade?

You need to be an economist, trader, and strategist just to buy groceries.

Value becomes liquid, contextual, dynamic.

Money = reputation + power + network signal

Strong currencies are issued by dominant entities.

The coin of a famous entrepreneur holds value, not from assets, but aura, influence and network. Money becomes symbolic capital. A signaling tool. A calling card.

Systemic risk

The system is hyper-fragile:

Trust breakdowns = instant currency collapse

Local chain-reaction crises

No coordination in a global shock

No risk mutualization. No lender of last resort

It’s Darwinian: every coin lives or dies alone.

Conclusion

The economic system of The Unincorporated Man is: Deregulated Silicon Valley capitalism + equity markets + human biography.

A world where the market didn’t just dominate society, it replaced it.