Autistic Antisocial Money: The Secret Art of Suspicious Wealth

How to Exploit Ambiguity, Reject Mimetic Desire, and Build Your First Million in Silence

Introduction

“The secret of great fortunes without apparent cause is a forgotten crime, because it was properly done.” - Balzac

Balzac saw clearly what others refuse to admit.

But there are nuances…

I made my first millions in the mid-2010s selling PDF files online. Not through Amazon, where ebooks race to $0.99 and every seller is forced into submission as a "price taker." Instead, I charged from $27 to $297 per PDF directly on my own ugly, uncelebrated websites—using direct response marketing (DRM) that returned 7 times every dollar invested, and compounding my earnings by relentlessly reinvesting every cent back into growth, year after year.

There was zero glamour, zero social validation. It was raw, ruthless profit. Outsiders looked on, perplexed. Suspicion was their natural response. How could wealth come so easily from something so mundane, so opaque?

Yet ambiguity is precisely where serious money begin. Big money thrives in uncharted territories: in blurred legality, silent markets, and audacity without permission.

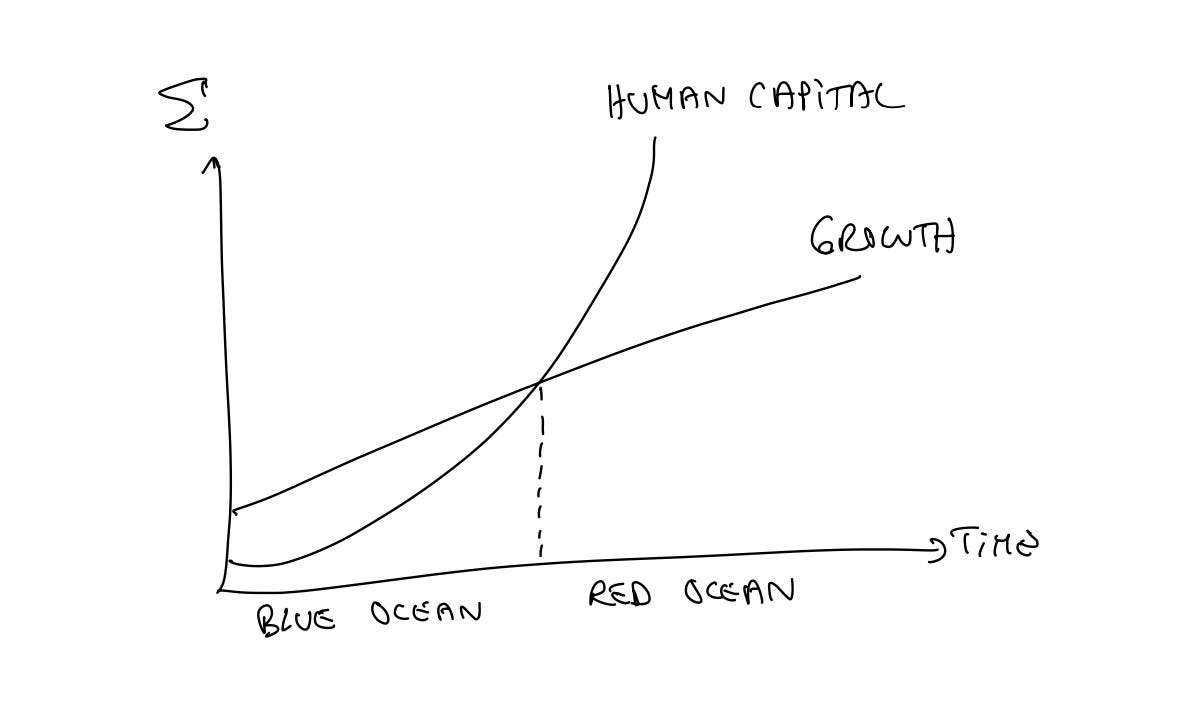

Crucially, it thrives in niches with minimal human capital, minimal competition, and minimal mimetic desire—places others instinctively avoid or ignore, leaving you alone to extract pure asymmetric profit."

This essay is about embracing that ambiguity, weaponizing antisocial focus, and making your first million without apologies, TED Talks, or startup storytelling.

Why Suspicious Wealth Thrives in Ambiguity

Real wealth rarely emerges from polished boardrooms or transparent, regulated marketplaces. The big scores happen in what I call la “phase sauvage” —the wild, blurry spaces untouched by consensus, legality, or moral clarity. This ambiguity is the natural habitat of outsized profits.

Former oligarch Mikhail Khodorkovsky understood this clearly. In the chaotic openness of Gorbachev’s 1987 glasnost and perestroika, he built an empire from nothing—while others waited timidly for permission. Similarly, Binance founder Changpeng Zhao (CZ) saw crypto’s long-term potential when Bitcoin was still a fringe curiosity, condemned by mainstream finance as a scam or passing fad.

Both men profited not merely from risk-taking, but from heretical foresight: the courage to believe in something that was socially unacceptable yet inevitably true.

If your wealth doesn't provoke suspicion, it's probably too conformist, too mimetic, too late. Ambiguity isn’t a flaw—it’s a competitive advantage.

Defining Autistic Antisocial Money

Autism, as a concept here, isn't a playful metaphor—it's an operational framework. It means cultivating an obsessive, almost pathological fixation on niches and opportunities the mainstream dismisses outright. It's about placing attention not just where others refuse to look, but where others actively avoid looking because it feels irrelevant, trivial, or even ridiculous. This kind of extreme, autistic-like focus is neither admired nor understood socially, but it's precisely why it works: no mimetic desire, no competition.

Antisociality complements this obsessive attention perfectly. Being antisocial doesn't mean mere introversion or social awkwardness—it's a deliberate, methodical rejection of the crowd's tastes, preferences, and beliefs. René Girard made this explicit: extraversion, empathy, and imitation drive human desire, pushing entire markets toward ruthless efficiency. In hyper-efficient markets, profits vanish because all opportunities become obvious, over-exploited, and competitively priced.

This is precisely the business inefficiency of extraversion: if everyone desires what everyone else desires, profit evaporates.

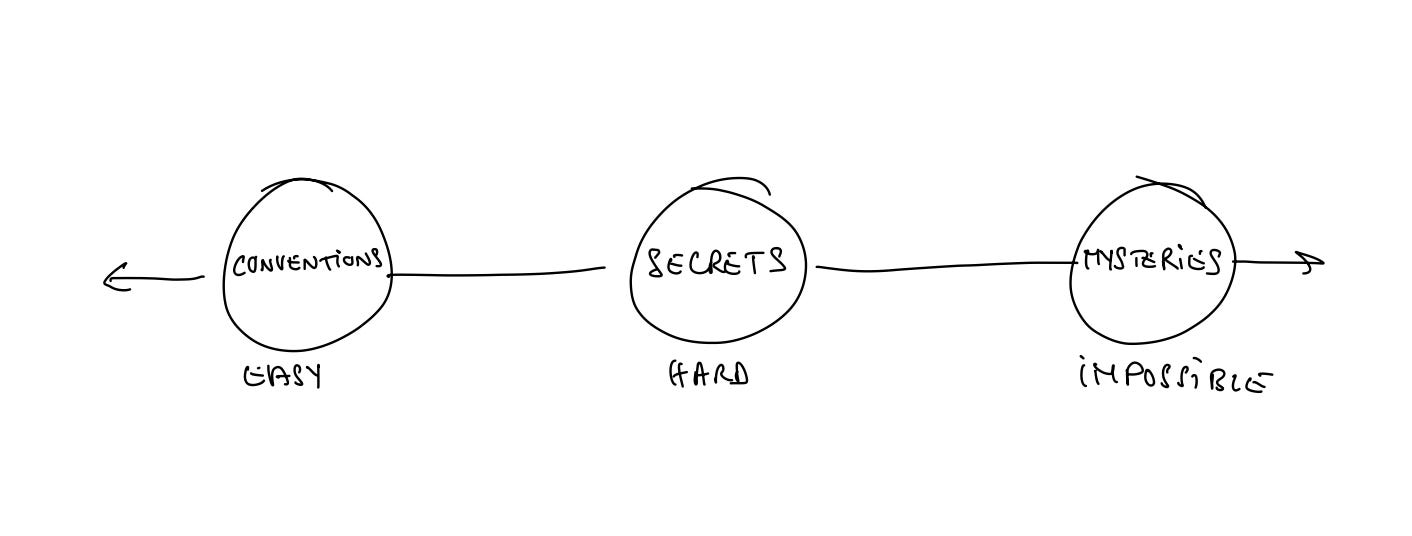

What you need instead is weaponized autism: a cold, socially indifferent obsession with unearthing overlooked truths. Facebook early investor Peter Thiel crystallized this insight clearly: real wealth emerges not from chasing popular mysteries or accepted conventions, but from recognizing ignored truths (“secrets”) that mainstream consensus refuses to acknowledge.

In practice, this demands the courage—and strategic discipline—to deliberately ignore social validation. Forget applause, admiration, prestige, or acceptance. Pursue instead the ruthless clarity of first principles. Think clearly, act without concern for mimetic approval, and wealth inevitably follows.

Macro vs. Micro Opportunities

Money emerges from asymmetries—gaps between what you understand and what everyone else believes. These gaps can appear on two distinct scales: macro and micro.

At the macro level, fortunes arise from contrarian worldviews (“Weltanschauung”). Consider scenarios that seem outrageous today but will feel inevitable tomorrow. Is our future Varoufakis’s techno-feudalism, where digital platforms enslave both data and labor? Or perhaps AI-driven communism, a hyper-efficient Gosplan managed by algorithms rather than bureaucrats? Maybe turbo-capitalism accelerates, leaving behind an irredeemable chasm between capital holders and everyone else. These scenarios are not mere thought experiments. They are roadmaps of tomorrow’s asymmetric wealth creation—heretical today, obvious in hindsight.

At the micro level, opportunities come from meticulous obsession with overlooked niches. Think dropshipping circa 2014: perceived as trivial, aesthetically repulsive, socially shameful, yet wildly profitable. Early adopters quietly made millions, precisely because the niche appeared beneath notice, beneath contempt.

Macro or micro—the strategy remains the same: identify asymmetries, reject consensus, and monetize what others refuse to see.

Core Antisocial Principles

Autistic antisocial money requires rigorous, systematic rejection: trends, consensus, aesthetics, morality, monopoly, transparency, mediocrity—and noise.

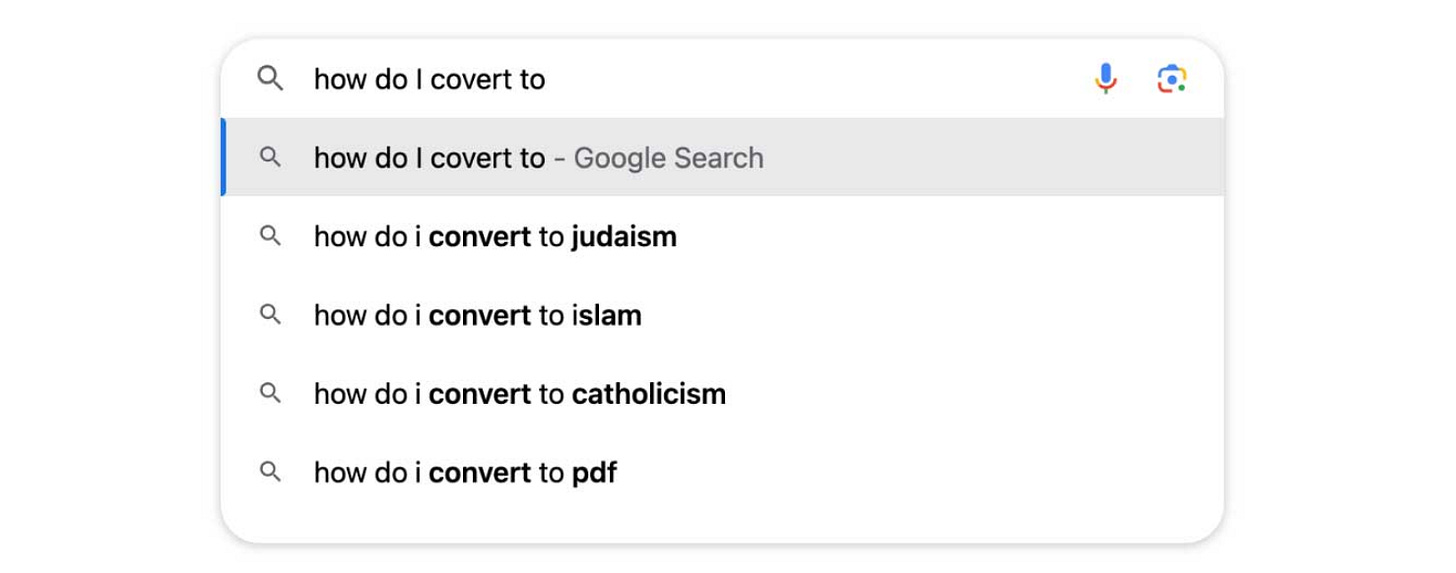

Reject trends. Trends are mimetic desire crystallized, crowded markets drained of profit. Wealth lies in secrets, never conventions.

Reject consensus. Assume mainstream opinions false until brutally proven true. Methodological flat-earthism clarifies hidden truths.

Reject aesthetic norms. Ugly converts better. Remember the hideous early-internet pages printing millions—proof that beauty signals conformity, not profit.

Reject false morality. Human vice is eternal, socially condemned, and extraordinarily profitable. French tech billionaire Xavier Niel’s fortune began in the sleazy shadows of “Minitel Rose,” a French proto-internet sex chat. Pump.fun, today's memecoin gambling platform, follows the same antisocial recipe—no apologies, pure profit.

Reject bourgeois monopolies. Symbolic violence, artificial scarcity, elite preservation—monopolies suffocate innovation. Uber slaughtered the taxi industry’s rent-seeking comfort with ruthless, antisocial disruption.

Reject transparency. Transparency attracts imitation, noise, competition. Strategic deception protects your margins. Koch Industries, the largest private company in America ($125 billion annual revenue), deliberately avoids public markets to keep strategic operations hidden and to escape regulatory disclosure.

Reject mediocrity. Follow Taleb’s barbell: embrace extremes, destroy safety. Mediocrity ensures zero wealth—antisocial money demands extremes.

Reject noise. Information matters only when it reduces uncertainty (Shannon, 1948). Profits hide in signals drowned by market noise. Autistic antisociality isolates pure signal from irrelevant distraction, extracting actionable truth from worthless chatter.

Each rejection pushes you further from mainstream approval and closer to authentic, suspiciously profitable wealth.

Operational Guidelines ("Dîner de Cons" Method)

In Francis Veber’s satirical masterpiece, Le Dîner de Cons, Parisian elites compete each week to invite the most spectacularly idiotic guest to dinner. The hidden cruelty? The idiot believes he's invited for his expertise—absurdly narrow obsessions like matchstick-model-building or boomerang throwing. Laughable. Ridiculous. Utterly autistic.

Yet, in our antisocial model, this idiot is precisely the one who wins.

His superhuman fixation on an obscure niche—a niche the mimetic majority finds irrelevant or humiliating—creates the perfect profit asymmetry. While the crowd mocks and dismisses, the autistic antisocial entrepreneur quietly monopolizes an overlooked, low-competition market.

Operationally, adopt a ruthless filtering process:

100 → 10 → 1.

Identify 100 niches, trends, or products initially dismissed as absurd or trivial.

Drill deep into 10 of them. Know everything: traffic sources, funnels, suppliers, copywriting angles, SEO intricacies, customer psychology. Become insufferable in your fixation, until people pity you.

Finally, choose just one opportunity. Execute brutally—blitzkrieg-style iteration, like Rocket Internet’s hyper-aggressive global launches (back in the days … they are more relaxed now).

Your first milestone is neither scale, nor press, nor validation—it’s the first dollar earned. From zero to one. Revenue is the purest signal, the unmistakable proof hidden in the market’s deafening noise. Without revenue, you have only speculation, vanity, delusion. With revenue, you hold tangible proof: concrete evidence of a profitable asymmetry that others have (maybe) failed to detect.

This autistic obsession, executed antisocially, is your strategic superpower—because no mimetic competitor will ever suspect that the "idiot" has already won.

Stealth, Security, and Legal Caution

Your wealth will draw suspicion—that’s the entire point. Suspicion repels imitators; transparency attracts them. The ambiguity surrounding your wealth will discourage mimetic competition. Suspicion shields your profits; openness invites crickets. Crickets are low-IQ, opportunistic copycats flooding profitable niches with noise, scams, and competition. You must protect your asymmetric advantage at all costs.

First principle: Strategically hide your success. Never brag. Never share revenue screenshots. Never build in public. Validation feeds vanity, vanity breeds vulnerability. Silence is leverage. Discretion is survival.

Second principle: Differentiate clearly between social taboos and legal boundaries. Black Swan author, Nassim N. Taleb is blunt: avoid jail, avoid death. While antisocial money thrives in moral ambiguity, legal ambiguity can ruin your life. Exploit societal hypocrisy relentlessly, but respect the bright red lines of legality.

Third principle: Strategic deception is legitimate protection. Google vehemently denies its monopolistic dominance even as it tightens its chokehold. Adopt a similar logic: conceal your true leverage. Disguise your asymmetric advantages behind layers of plausible deniability.

Stealth isn’t paranoia; it’s pragmatic. Privacy isn’t cowardice; it’s cunning. Antisocial money demands strategic invisibility.